Venture capital funds are essential in nurturing early-stage companies with significant growth potential. Key to managing these funds is a thorough understanding of cash flow dynamics. This guide will walk you through building a venture capital fund cashflows model, ensuring your fund’s financial sustainability by tracking performance, investment activity, and making informed decisions. We have also built a ready-to-go Venture Capital Fund Cashflows Model Template for use by any Limited Partners (LPs) or General Partners (GPs) wanting to model their Venture Capital Fund out over a 10 year period or anyone looking to understand how a Venture Capital Fund operates and the investor cashflows that flow through.

What is a Venture Capital Fund Cashflows Model?

A venture capital fund cashflows model is critical for monitoring and forecasting money movement in and out of a fund. This model highlights capital inflows like contributions from limited partners and outflows such as investments, management fees, and distributions. With a VC Portfolio Construction Model and Cash Flows Template, managers can ensure sufficient liquidity for strategic investments and returns to investors.

Why a Cashflow Model is Important for a Venture Capital Fund

Capital Management

A cashflow model helps managers monitor capital commitments, ensuring transparent communication with investors and performance tracking for strategic decision-making. Check out Venture Capital Fund Modeling: A Guide for Success for insights into modeling investment activity and exit strategies.

Step 1: Understand the Key Components of a Venture Capital Fund

Fund Structure

Understand the roles of General Partners (GPs) and Limited Partners (LPs). GPs manage the fund while LPs contribute capital. Learn more about structuring a fund with How to Model a Venture Capital Fund.

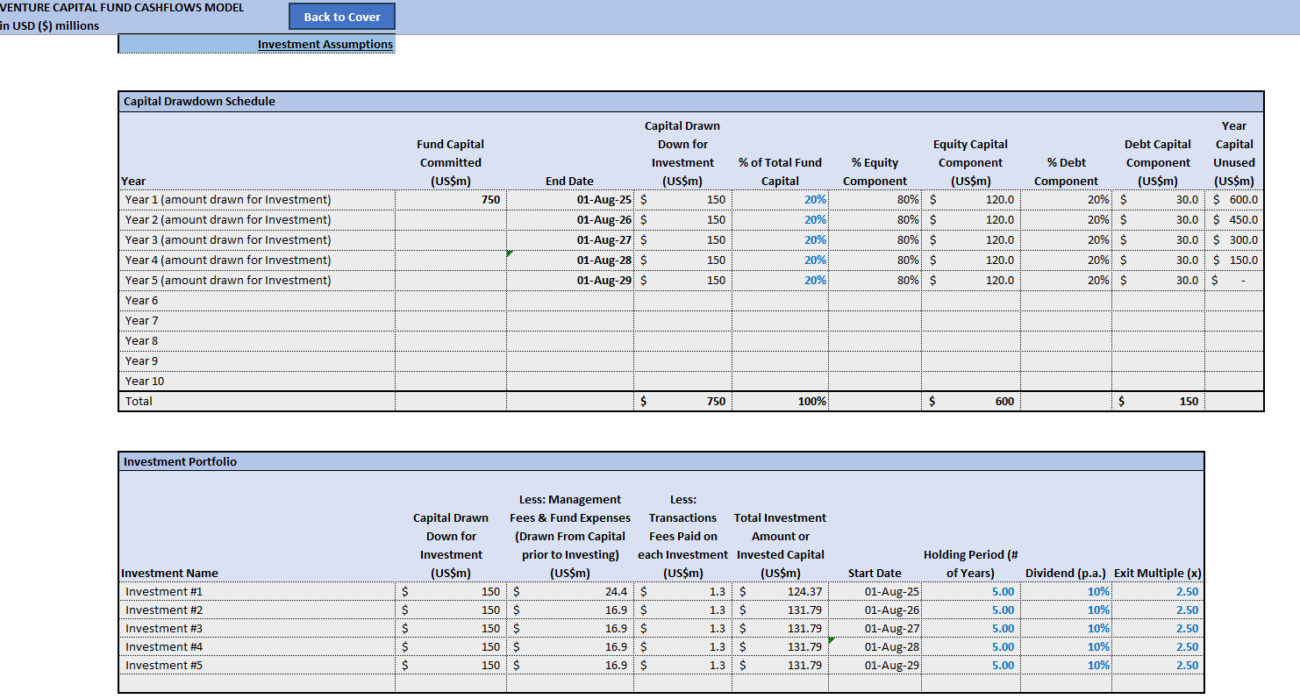

Capital Commitments and Contributions

Capital calls are scheduled over time as investments are made. This ensures steady investment without liquidity shortages.

Investment Strategy and Deployment

Venture capital funds invest in emerging companies at various stages. Model deployment with 7 Steps to Build a VC Fund Model.

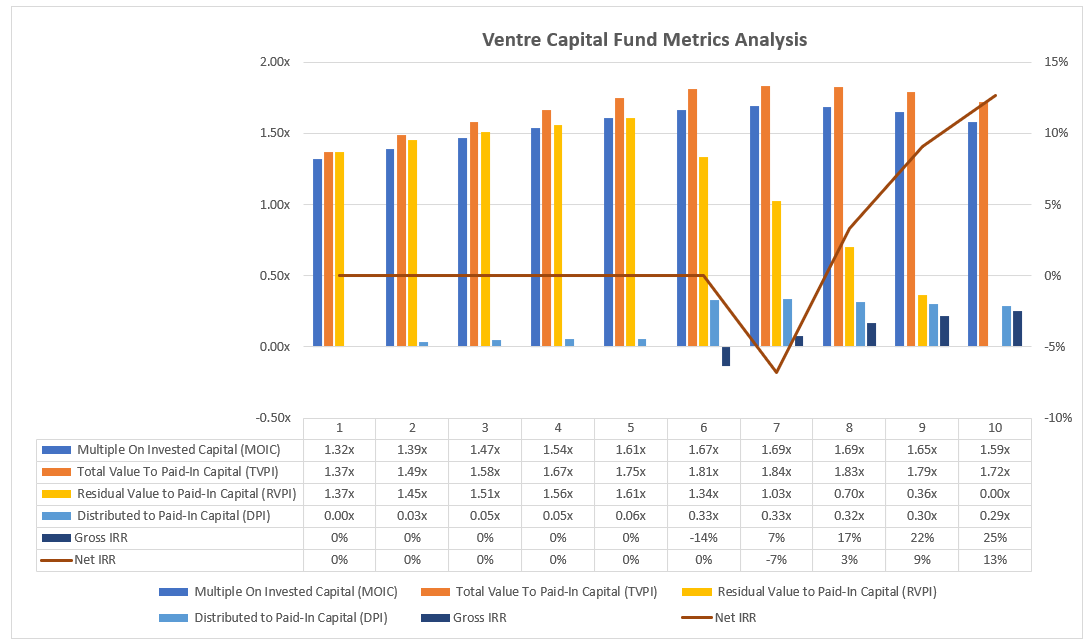

Management Fees and Carried Interest

Funds charge management fees as a percentage of committed capital, typically 1.5%-2.5%. They also earn carried interest, usually 20%-30% of profits after exceeding a hurdle rate.

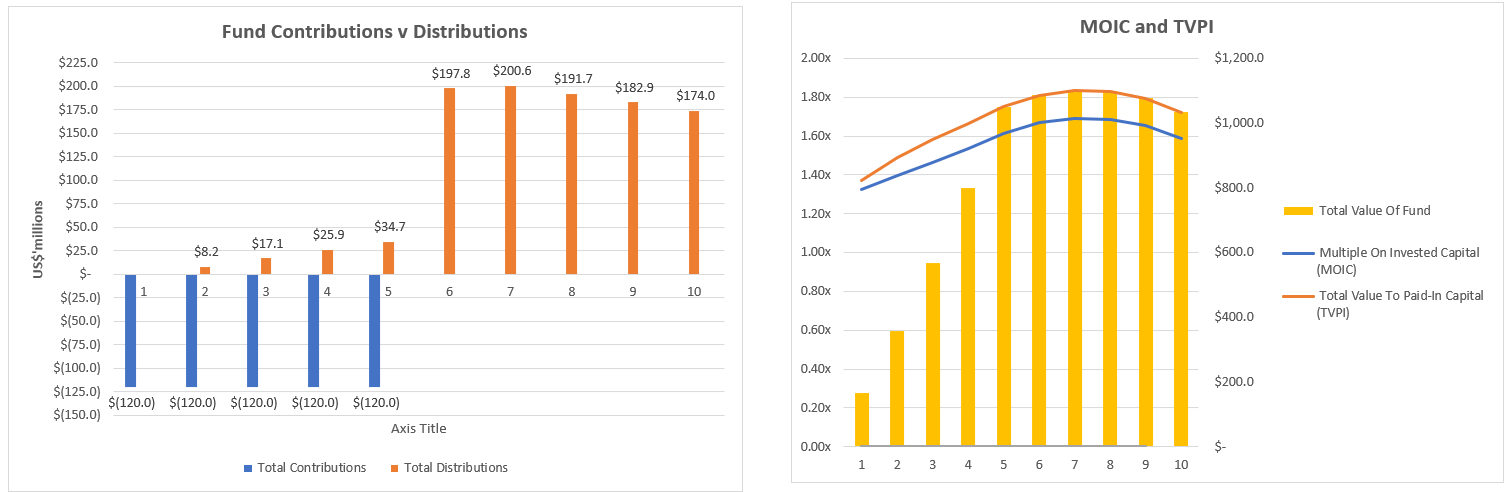

Distributions

Funds distribute returns post-investment exits, rewarding both LPs and GPs. Explore forecasting returns in detail with the Venture Capital Model | Foresight.

Step 2: Create the Basic Framework for Your Cashflows Model

Capital Calls

Track capital commitments from LPs over the fund’s life.

Investment Deployment

Monitor amounts invested into startups to ensure equity acquisition aligns with strategy.

Management Fees

Calculate annual fees as a percentage of committed capital during the investment period.

Carried Interest

Record profits distributed to GPs using a structured table, ensuring alignment with the venture capital method.

Distributions

Allocate capital and profits due to LPs and GPs transparently.

Step 3: Build the Financial Model Structure

Utilize Excel or a financial tool to design and track commitments, investments, fees, profits, and distributions. Discover efficient forecasting through Cash Flow Model Forecasting.

Step 4: Forecast Future Cashflows

Construct a comprehensive 10-year forecast, evaluating capital call timing, investment schedules, and exit predictions using resources like Venture Capital Fund Cashflows Model Template.

Step 5: Monitor and Adjust the Model

Update the cashflow model with evolving fund data to maintain accurate forecasts and manage EuVECA-designated gains.

Final Thoughts!

Building a venture capital fund cashflows model is integral to ensuring a fund’s smooth operation and success. By effectively managing capital commitments, tracking essential investments, monitoring management fees, and preparing detailed exit strategies, you ensure strategic fund growth and sustainability.

Frequently Asked Questions

What are the primary components of a VC fund?

A VC fund consists of General Partners managing investments, Limited Partners providing capital, and structures for fees, carried interest, and distributions.

How do management fees impact a fund?

Management fees cover operational costs, calculated as a percentage of committed capital, influencing fund liquidity.

Why is forecasting important in a VC fund?

Forecasting ensures optimal capital deployment and timing of investments, exits, and profits, vital for strategic fund management.