Break-even analysis is an essential financial calculation that every business owner should understand. It helps determine the level of sales or revenue needed to cover total costs, ensuring that a venture is financially viable. Understanding this concept can aid in strategic planning, resource allocation, and price setting.

Understanding Break-Even Analysis

Break-even analysis provides crucial insights into the balance between costs and revenues. It identifies the break-even point where total costs equal total revenues, meaning the business neither makes a profit nor incurs a loss. This analysis helps businesses evaluate their financial performance and make informed decisions regarding pricing and production. To dive deeper, check out the Corporate Finance Institute’s resource on break-even analysis.

Fixed and Variable Costs

In break-even analysis, understanding the difference between fixed and variable costs is crucial. Fixed costs remain constant regardless of the volume of production, such as rent, salaries, and insurance. On the other hand, variable costs fluctuate with production levels, including materials and labor. Accurately identifying these costs allows businesses to calculate their break-even point more effectively. For an in-depth formula and calculation, visit Investopedia’s guide.

Calculating the Break-Even Point

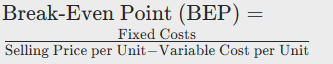

To calculate the break-even point, businesses need to evaluate their fixed and variable costs relative to their unit sell price. The formula employed is:

This calculation will provide the number of units that must be sold to cover all expenses. Learn how to apply this formula with Square’s detailed guide.

The Role of Contribution Margin

The contribution margin plays a significant role in break-even analysis. It represents the portion of sales revenue that contributes to covering fixed costs after accounting for variable costs. A higher contribution margin indicates that fewer units need to be sold to reach the break-even point. For more insights, visit the GoCardless explanation.

Why Break-Even Analysis is Important

Performing a break-even analysis aids businesses in strategic planning and decision-making. It ensures that businesses set realistic sales targets and pricing strategies to achieve profitability. By understanding the break-even point, businesses can make informed decisions about scaling operations, adjusting prices, and investing in new ventures. Read more on MYOB’s perspective.

When to Use Break-Even Analysis

- Startup Planning: Assessing the viability of a new business.

- Pricing Strategies: Adjusting prices to meet financial goals.

- Investment Decisions: Evaluating the potential profitability of new ventures.

- Performance Evaluation: Monitoring sales and turnover against financial projections.

Find additional strategies in the NetSuite resource.

Frequently Asked Questions

What is the contribution margin?

The contribution margin is the amount remaining from sales revenue after variable expenses are deducted. It contributes to covering fixed costs and generating profit.

How does increase in fixed costs affect break-even?

An increase in fixed costs will raise the break-even point, requiring more sales to achieve profitability.

Can break-even analysis help in forecasting?

Yes, break-even analysis provides a baseline for forecasting sales and evaluating the financial feasibility of business operations.

Final Thoughts!

Break-even analysis is a vital financial performance tool that helps businesses navigate their financial landscape. It equips entrepreneurs with the knowledge needed to make strategic decisions that align with their profitability goals, resulting in more efficient operations and greater economic stability.