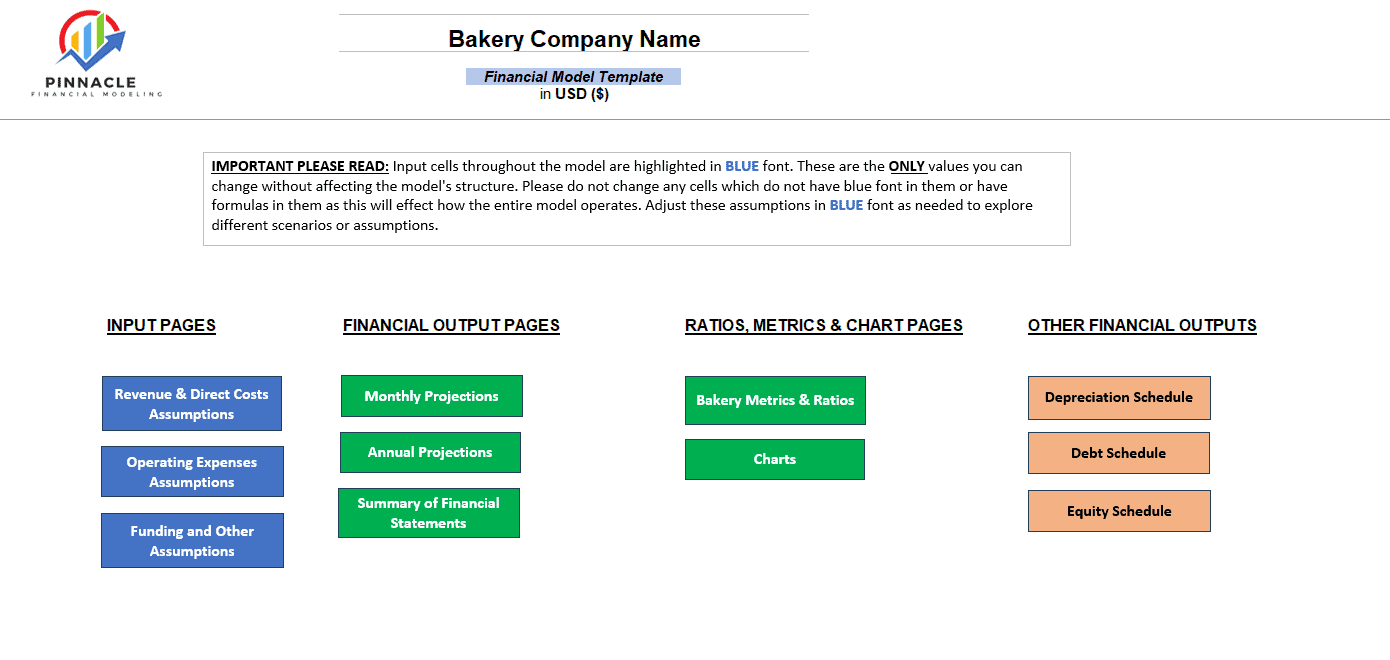

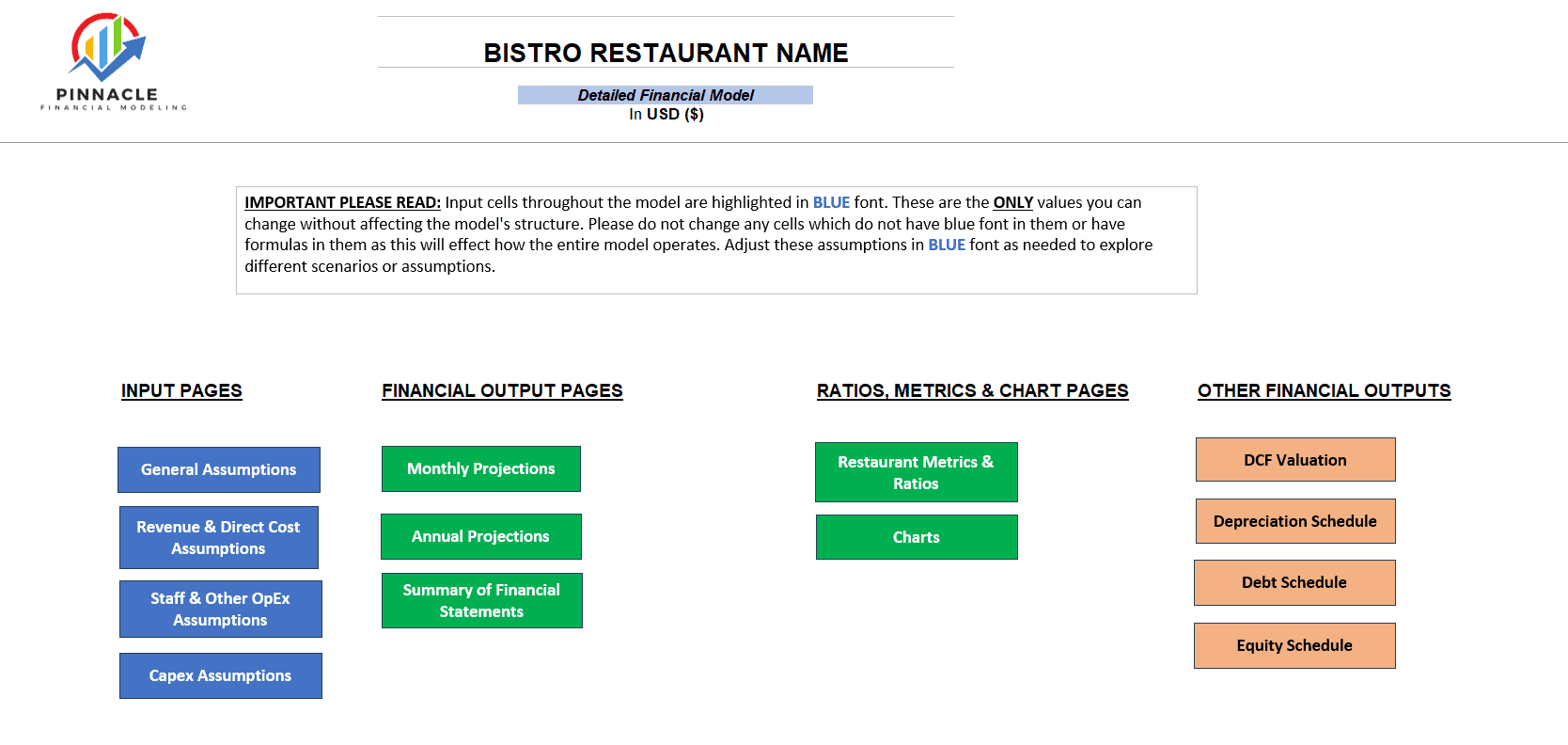

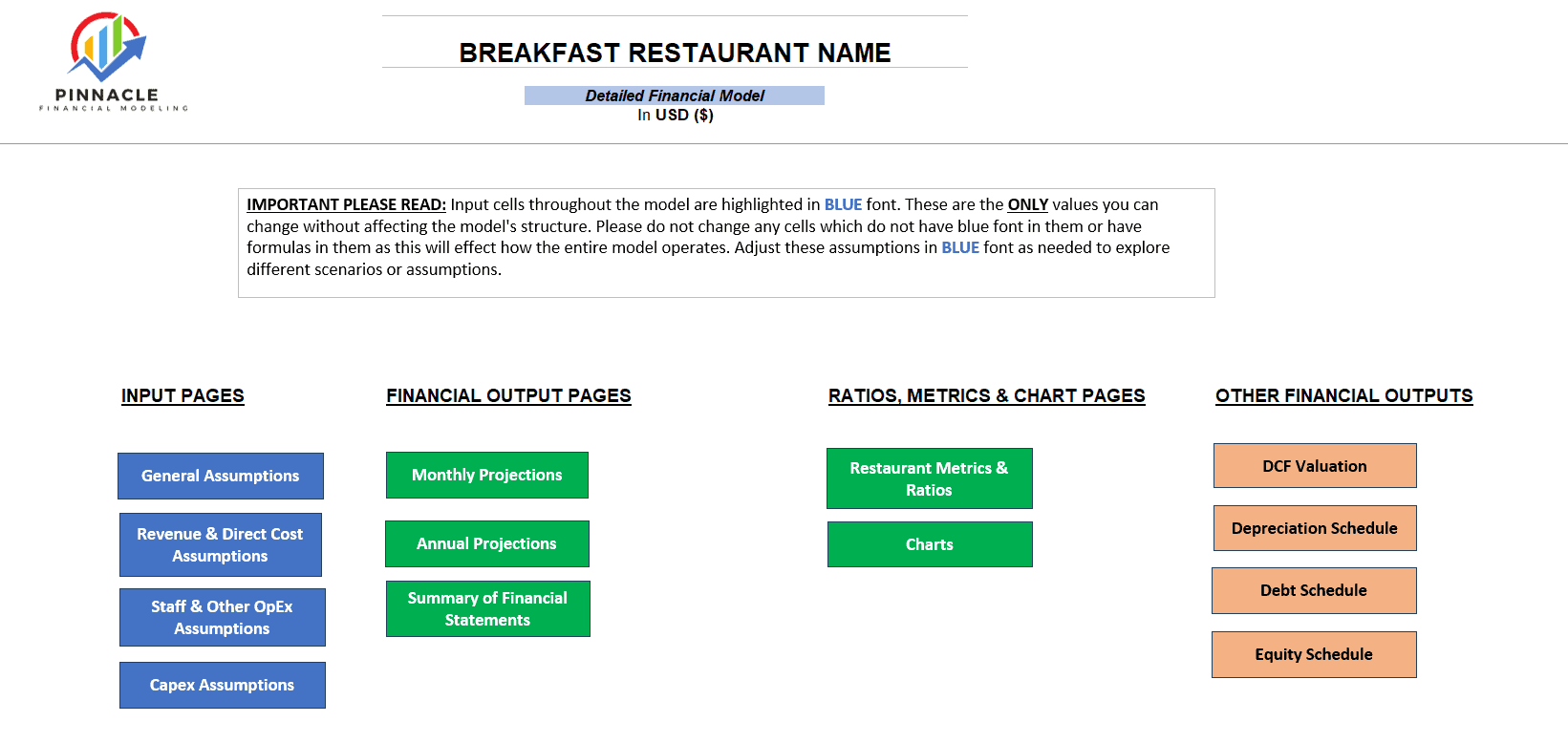

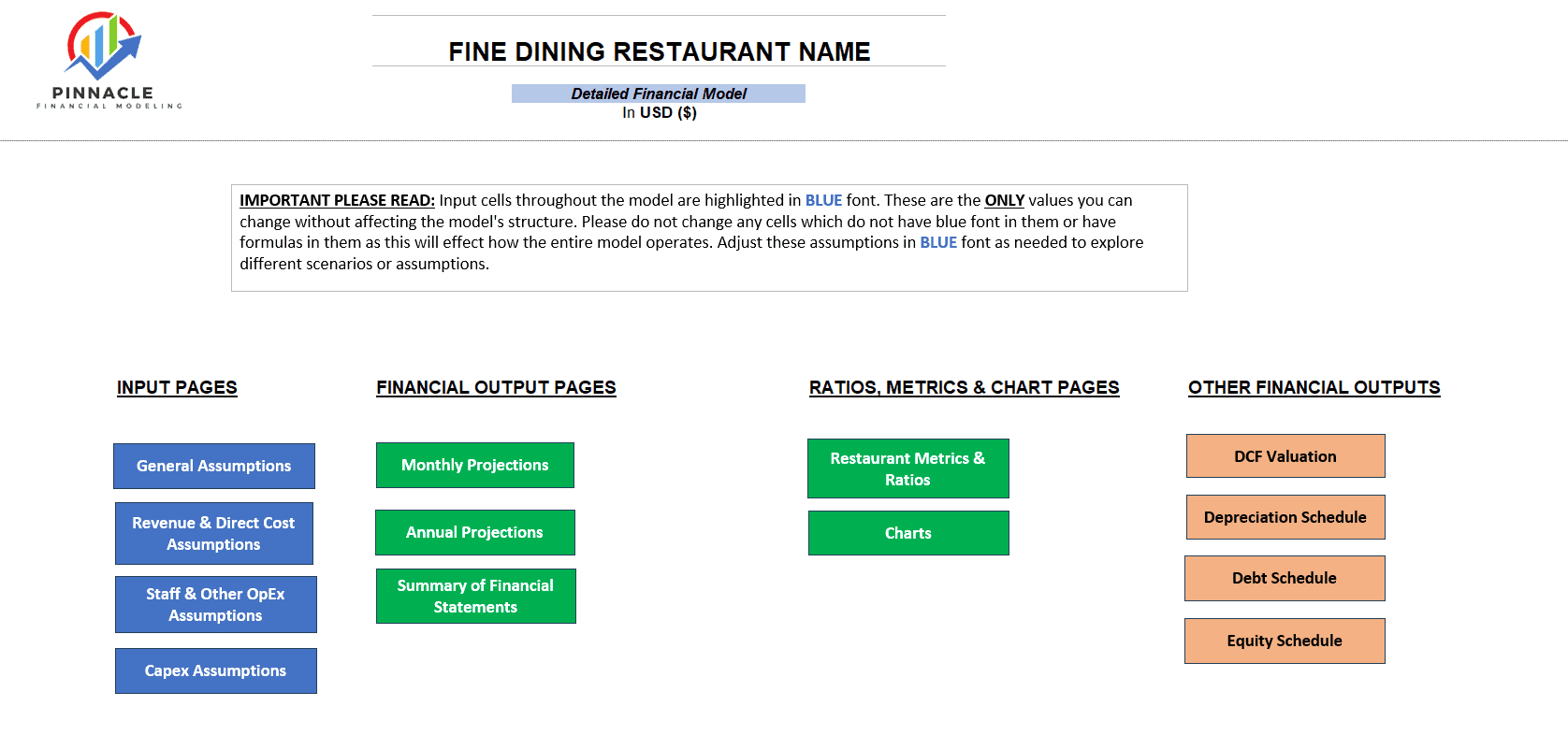

This model includes all the key variables you would need to consider with specific Bakery metrics you can track (Revenue by Product, Direct Costs as a % of Revenue, Operational Costs as a % of Revenue). Users will easily be able to navigate the model with all input fields highlighted in Blue font.

These models are designed to be the perfect financial tool for business owners to use to make decisions for their Bakery business and also to provide to a snapshot of how the business is currently performing and what the forecasts look like.

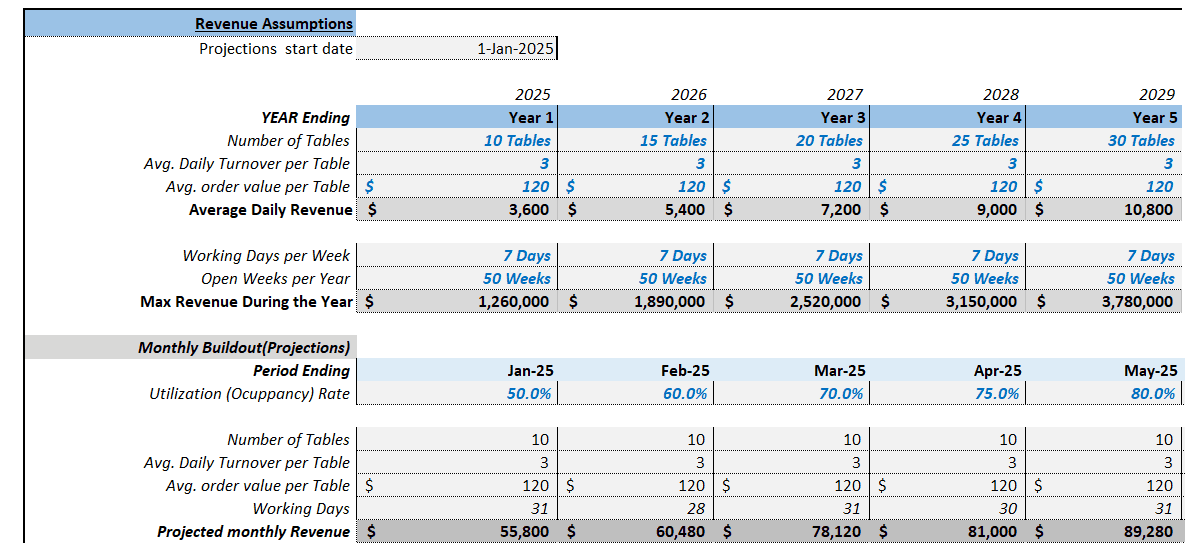

Revenue & Direct Costs Assumptions

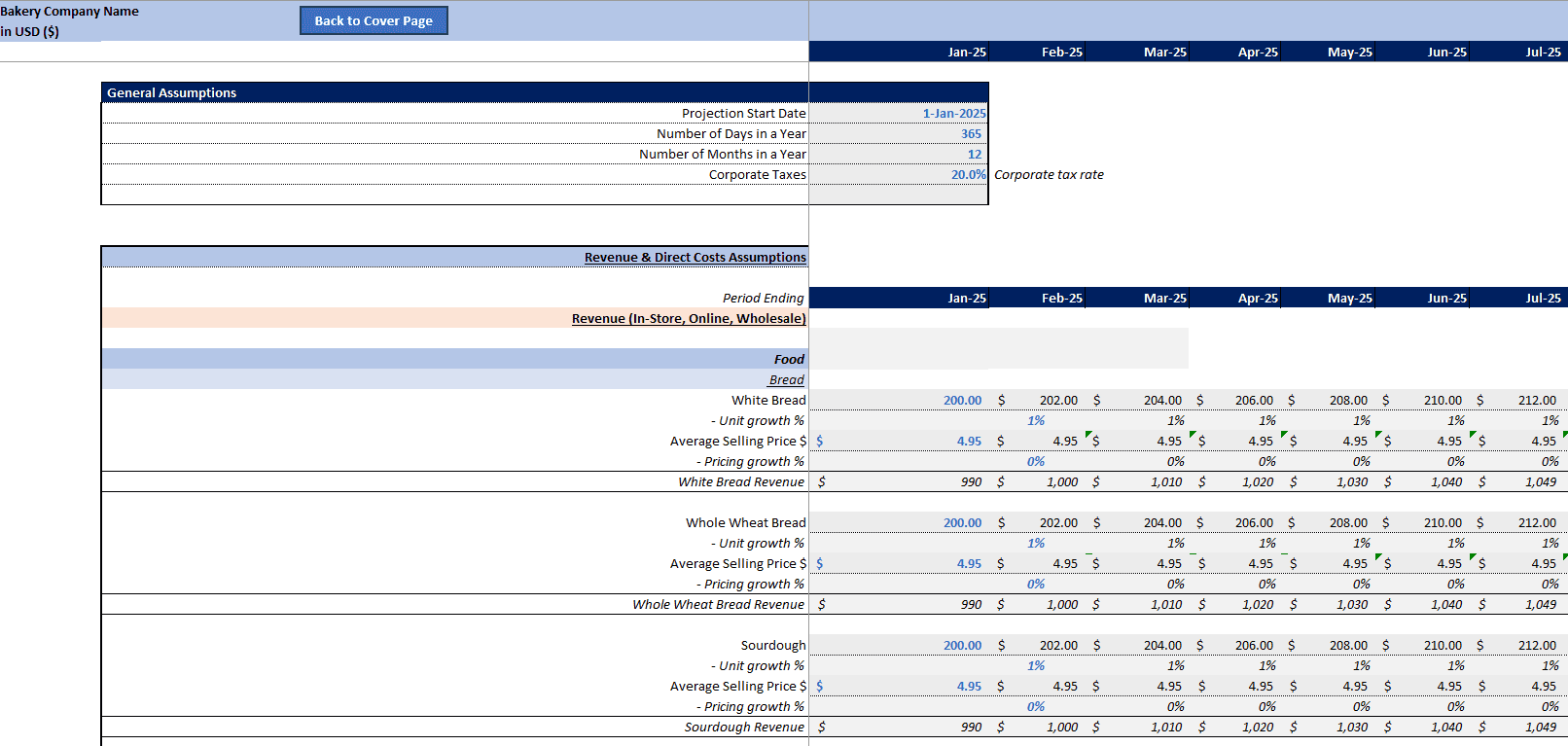

Starts with basic model questions on the Start date of the model and corporate tax rate %.

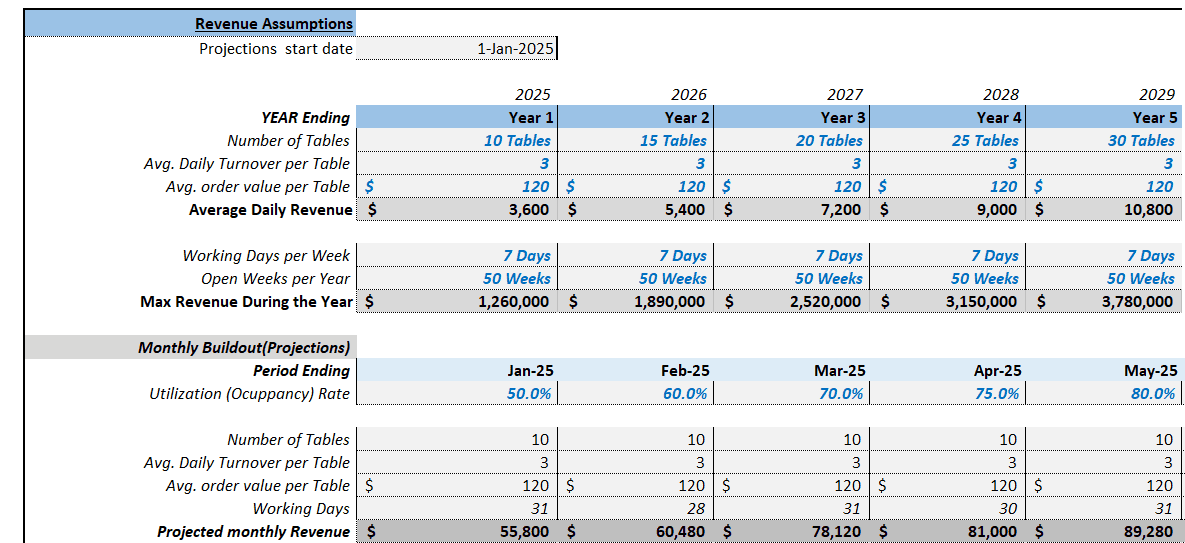

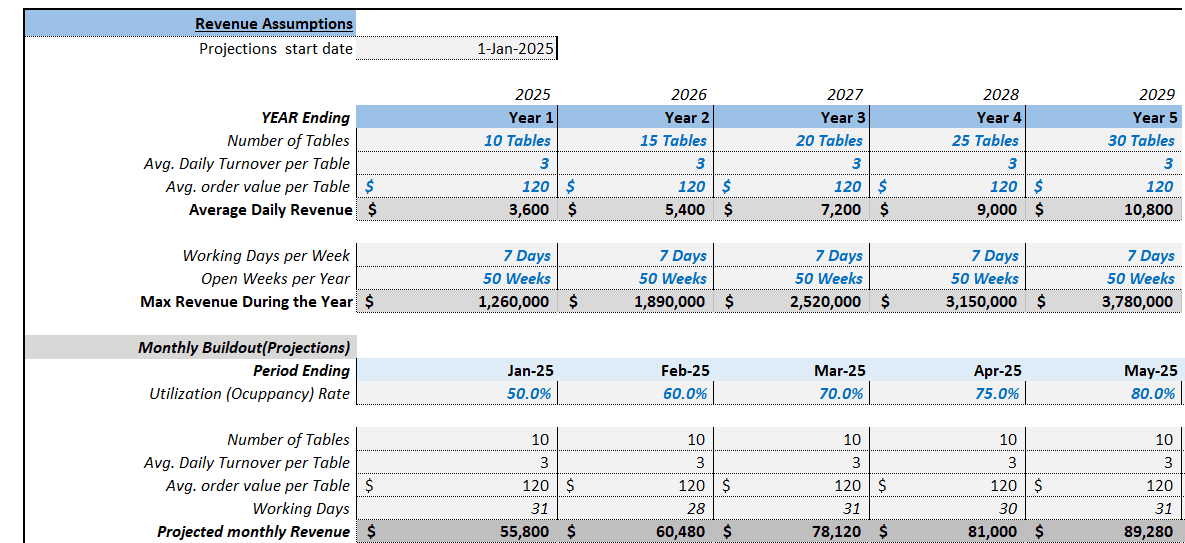

Revenue assumptions are the anticipated factors that drive a company’s income generation over a specific period. These assumptions form the basis for financial projections and are crucial for planning and decision-making. Our model includes detailed inputs for Revenue (In-Store, Online, and Wholesale) with specific Revenue Product categories and item forecasts for Bread, Pastries, and Beverages (Unit # Growth and Pricing Growth %).

Direct Costs assumptions are the costs directly attributable to a company’s Revenue. We have included inputs on the likely Bakery direct costs of Ingredients as a % of Revenue, Packaging Costs as a % of Revenue, and Labor Costs (Bakers and Other Staff) as a % of Revenue.

Operating Expenses Assumptions

Operating expense assumptions are typically based on historical data, industry benchmarks, market trends, and management’s judgment. They are crucial for estimating the business’s total cost and determining profitability. Like revenue assumptions, it’s essential to regularly review and adjust operating expense assumptions to reflect changes in the business environment and ensure the accuracy of financial forecasts. Our model included detailed inputs on Staff Costs (Owner, Administrative Staff), Typical Bakery-related Operational Expenditure items, including Utilities, Maintenance & Repairs, Insurance, Marketing & Advertising Costs, Supplies & Other Costs, Rent, and Professional Services Fees. However, you can add any other expenses relevant to your business to this sheet.

Capex Assumptions

Capital expenditure (Capex) assumptions refer to the anticipated investments a company plans to make in long-term assets, such as property, equipment, and technology, over a specific period. These assumptions are crucial for financial planning, budgeting, and forecasting, impacting the company’s cash flow, profitability, and growth prospects. We have included a Detailed list of likely Initial Capex Costs, including Commercial Ovens, Refrigeration Units, Mixes & Food Processors, Baking Racks, Worktables & Countertops, Point-Of-Sale (POS) Systems, Kitchen Exhaust Systems, Dishwasher & Sinks, other capex-related costs; as well as a corresponding Fixed Asset Register. We have also given an assumption on Capital Structure (i.e. if Capex costs were funded entirely through Equity or Debt or a mixture of both).

Monthly Projections (10-year period)

We have broken down projection’s month-by-month when projecting income statements, balance sheets, and cash flow statements. The monthly forecast is provided over a 5-year time frame. This is particularly useful for businesses looking at month-on-month trends and insights, which leads to better decision-making and budgeting should there be a need to raise more capital, pursue growth opportunities from excess capital, or pay down interest-bearing debt. Monthly projections also help a business ascertain seasonal performance when looking at growth projections on a month-over-previous-years-month basis.

Annual Projections (10-year period)

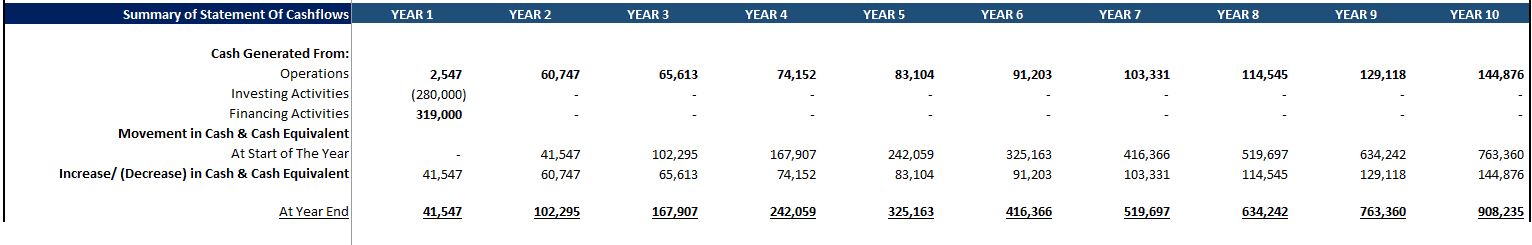

The model has Annualized Financial Projections of Income Statement, Balance Sheet, and Cash Flow Statement over 5 years. Annual projections provide an excellent overview of expected revenues, expenses, profits, cash flow, and other key financial metrics for the upcoming year. Yearly predictions are essential for any company’s strategic planning, budgeting, fundraising, and performance evaluation at any stage of its business cycle.

Bakery Metrics & Ratios

Bakery-specific metrics (Revenue by Product, Direct Costs as a % of Revenue, Operational Costs as a % of Revenue), Profitability Ratios, Liquidity Ratios, and Asset Turnover Ratios were provided.

Summary of Financial Statements (10-year period)

Summarized Financial Statements over a 10-year time frame help for better snapshots of financial performance. Income Statement, Balance Sheet, and Cash Flow Statement are all provided.

Charts

Charts available, including Profitability Analysis and Use of Funds Chart.

Depreciation Schedule

The detailed Depreciation Schedule shows additions/disposals to the business’s Fixed Asset Register of the company. Sections included Commercial Ovens, Refrigeration Units, Mixes & Food Processors, Baking Racks, Worktables & Countertops.

Debt Schedule

Debt schedule provided with interest rate assumptions and payback period assumptions included.

Equity Schedule

Equity schedule provided with assumptions on all investments into the business by investors or owners.

J.K. –

Absolutely love this model! Just what I was after to model out our bakery financials. Easy to use and great price. Thank you!