A Profit and Loss (P&L) Statement, also known as an income statement, is critical for assessing a business’s financial health. It provides a detailed overview of a company’s revenue, costs, and expenses over a specific time, helping business owners, investors, and stakeholders understand profitability. For beginners, it might seem daunting to create a profit and loss statement, but using a reliable template can simplify this process significantly. We have built several financial model templates in our shop by industry, all of which showcase an easy to follow Profit and Loss Statement for Founders.

What is a Profit and Loss Statement?

A P&L statement summarizes a business’s revenue, costs, and expenses over a specific period. It offers insights into business profitability, operational efficiency, and cost structures. Typically, a P&L statement consists of:

- Revenue: Income from sales or services.

- Cost of Goods Sold (COGS): Direct costs of production.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Indirect costs like utilities and salaries.

- Net Profit or Loss: Final profit/loss after all expenses.

Why is a Profit and Loss Statement Important?

Assessing Profitability

A P&L statement is essential for determining business profitability. It provides a clear picture of earnings versus spending, helping to ensure that your business is financially stable.

Financial Planning and Decision Making

Regularly reviewing your P&L statement aids in making informed decisions about cost-cutting, revenue increasing, or operational adjustments to boost profitability. Business tools, like those offered by Business Victoria, can assist in this process.

Tracking Performance

By tracking financial performance over time, you can pinpoint trends and areas for improvement, ensuring continuous growth and stability. Using P&L templates from services like Coefficient can enhance business efficiency.

Securing Funding

Lenders and investors often require a P&L statement to assess financial health. It demonstrates the company’s ability to manage debts and generate returns. QuickBooks’ free templates are designed to help manage small business finances efficiently.

Key Components of a Profit and Loss Statement Template

Revenue (Sales)

Revenue is the total income from goods or services sales. It includes income from core business operations and excludes non-operating income like investments. Accurate categorization, as seen in templates from Wise, is crucial for financial accuracy.

Cost of Goods Sold (COGS)

COGS refers to direct production costs like raw materials and labor. For a clear understanding of profit margins, precise calculation of COGS is necessary.

Gross Profit

Gross profit is the difference between revenue and COGS. It indicates efficiency in the core business. Regular analysis will help maintain healthy profit margins.

Operating Expenses

These are indirect costs required to run the business. Proper categorization into fixed and variable costs helps manage expenses effectively.

Net Profit (Net Income)

Net profit is the ultimate indicator of business profitability. It considers all expenses and income, showing the actual financial outcome.

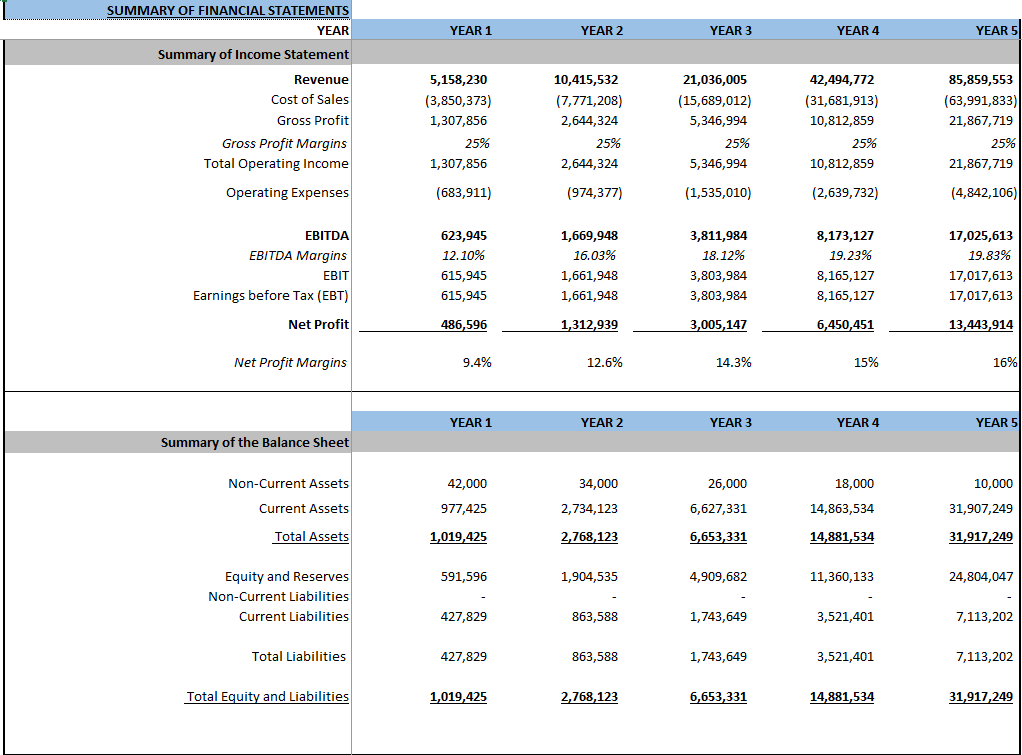

Sample Profit and Loss Statement Template

Here’s an example to help visualize the key components:

| Category | Amount (USD) |

|---|---|

| Revenue | |

| – Sales of Products | $100,000 |

| – Service Fees | $10,000 |

| Total Revenue | $110,000 |

| Cost of Goods Sold (COGS) | |

| – Raw Materials | $20,000 |

| – Direct Labor | $15,000 |

| – Manufacturing Costs | $5,000 |

| Total COGS | $40,000 |

| Gross Profit | $70,000 |

| Operating Expenses | |

| – Rent | $2,000 |

| – Utilities | $500 |

| – Salaries | $15,000 |

| – Marketing | $3,000 |

| – Insurance | $500 |

| Total Operating Expenses | $21,000 |

| Operating Income (EBIT) | $49,000 |

| Interest and Taxes | |

| – Interest Expense | $1,000 |

| – Taxes | $2,000 |

| Total Interest and Taxes | $3,000 |

| Net Profit | $46,000 |

Frequently Asked Questions

What is a profit and loss statement used for?

A P&L statement helps assess profitability and guides financial planning, decision-making, and performance tracking.

How often should a P&L statement be updated?

Ideally, update your P&L statement monthly or quarterly to monitor financial health and trends.

Where can I find free P&L statement templates?

There are several free P&L templates available online, such as those from Xero and other business management platforms.

Final Thoughts!

A profit and loss statement is indispensable for understanding a business’s financial position. By utilizing appropriate templates and regularly reviewing your P&L statement, you can ensure a clear view of revenue, expenses, and profitability. This financial tool not only aids day-to-day management but also sets the stage for strategic planning and secure financial future.